The Rise of Sustainable Investing: A Beginner’s Guide to ESG Funds in 2024

In recent years, the focus on sustainability has revolutionized the way people invest. With global challenges like climate change, social inequality, and corporate responsibility gaining attention, Environmental, Social, and Governance (ESG) investing has emerged as a powerful trend. ESG funds allow investors to align their financial goals with their values, creating a portfolio that benefits both the investor and the planet. This guide explores sustainable investing, its advantages, risks, and how beginners can start in 2024.

What Is ESG Investing?

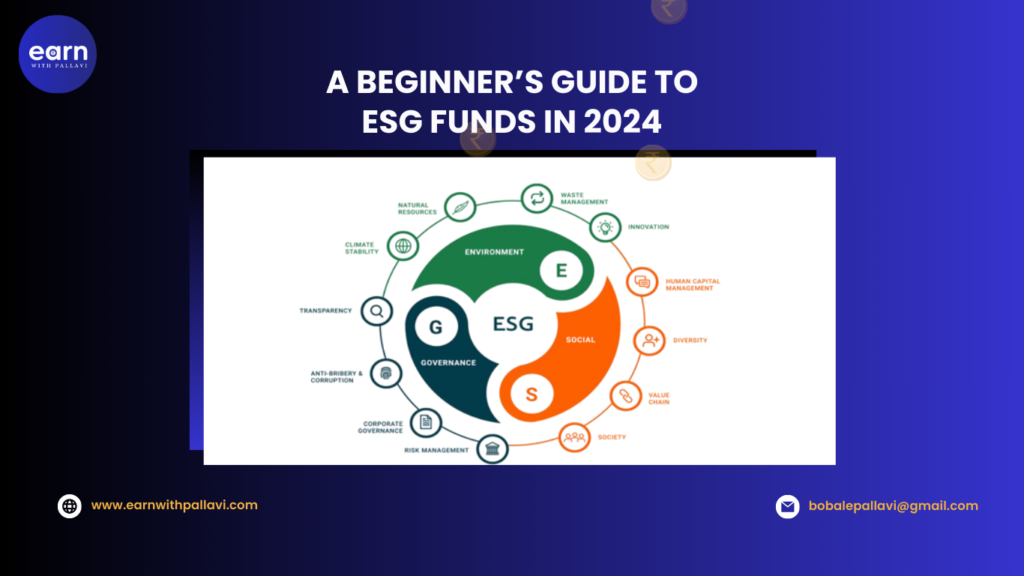

Sustainable investing integrates ESG factors into investment decisions to promote long-term growth and positive societal impact. ESG factors include:

- Environmental (E): Efforts to reduce carbon footprints, adopt renewable energy, and ensure sustainable resource usage.

- Social (S): Prioritizing diversity, ethical labor practices, and community engagement.

- Governance (G): Transparent leadership, ethical business practices, and accountability.

In essence, ESG investing rewards companies for being environmentally conscious, socially responsible, and well-governed.

Why Choose Sustainable Investing in 2024?

The ESG movement has gained momentum as investors recognize the potential for financial growth coupled with positive impact. Here’s why you should consider ESG funds:

1. Competitive Financial Returns

Contrary to misconceptions, ESG investments have shown strong performance, often matching or surpassing traditional funds.

2. Risk Mitigation

Companies with sound ESG practices are less likely to face scandals, regulatory penalties, or reputational damage, making them safer investment options.

3. Aligning with Personal Values

For many, ESG investing is about more than money. It’s an opportunity to support businesses working to solve global challenges.

4. Long-Term Growth Potential

As governments and corporations emphasize sustainability, ESG investments are positioned for significant future growth.

How to Get Started with ESG Investing

Step 1: Learn About ESG Funds

There are several types of ESG funds, including mutual funds and ETFs. Beginners can explore popular funds like:

- iShares MSCI ESG Leaders ETF

- Vanguard FTSE Social Index Fund

- PIMCO ESG Income Fund

Learn more about ESG fund options.

Step 2: Understand ESG Ratings

ESG funds are rated by organizations like MSCI or Sustainalytics based on their environmental, social, and governance performance. Understanding these ratings helps investors make informed choices.

Step 3: Choose an Investment Platform

Platforms like Robinhood, Fidelity, and Betterment offer ESG investment options with user-friendly interfaces. Look for platforms that provide detailed fund analysis.

ESG Funds vs. Traditional Investments

1. Financial Performance Comparison

Numerous studies indicate that ESG funds offer competitive returns. The inclusion of socially responsible companies can reduce volatility and ensure consistent growth.

2. Impact on Society and the Planet

Traditional funds often invest in industries with significant environmental impact, such as fossil fuels. ESG funds, however, focus on renewable energy and ethical practices.

Benefits of ESG Funds

1. Positive Environmental Impact

ESG funds channel money into companies working toward carbon neutrality, renewable energy, and resource conservation.

2. Improved Social Standards

By investing in socially responsible companies, ESG funds promote better labor practices, diversity, and community engagement.

3. Enhanced Corporate Governance

Governance-focused companies prioritize accountability, transparency, and shareholder value, minimizing risks of fraud or scandals.

Key Risks in ESG Investing

- Greenwashing

Some companies overstate their sustainability efforts. Investors must research thoroughly to avoid misleading claims. - Higher Fees

ESG funds often have slightly higher management fees compared to traditional funds.

Limited Historical Data

Many ESG funds are relatively new, offering less historical performance data.

Tips for Evaluating ESG Funds

When selecting ESG funds, consider these criteria:

- Carbon Emission Scores: A measure of environmental impact.

- Diversity Index: Evaluation of leadership inclusivity.

- Governance Metrics: Transparency and accountability standards.

The Future of ESG Investing

1. Global Adoption

Governments worldwide are implementing stricter sustainability regulations, encouraging companies to adopt ESG principles.

2. Investor Awareness

More individuals are learning about ESG investing, driving demand for sustainable investment products.

3. Technological Integration

Platforms are developing AI tools to analyze ESG metrics, simplifying investment decisions for beginners.

Conclusion: Building a Sustainable Portfolio

ESG investing represents a shift in how we view finance—moving beyond profits to create a positive impact. By choosing sustainable investments, you contribute to a healthier planet and a fairer society while securing your financial future. Start small, research thoroughly, and make 2024 the year you embrace sustainable investing.

If you have any questions or need guidance, feel free to contact us.